It may be possible that an invoice has been issued wrongly or with incorrect amounts. Once the invoice is posted to the finance system, it is usually not possible to reverse this process. In such a case, a Credit Note must be issued for correcting the situation.

Invoice reversal basically involves creating Credit Notes of the reversal amount. There may be two possibilities:

Reversing the Whole Invoice

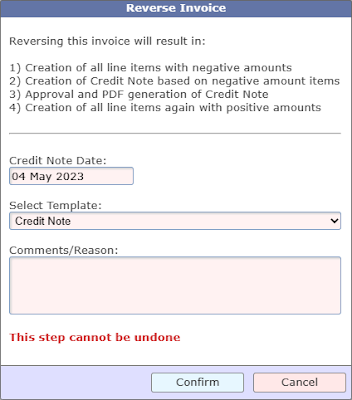

In case, the invoice was issued wrongly and the entire amount needs to be reversed, TrakIT offers a shortcut way to reverse the entire invoice. There is a button 'Reverse Invoice' available on the Invoice page.

After selecting the Credit Note template and reason for reversal, TrakIT will perform the reversal as mentioned in the steps. The reversal cannot be undone.

Invoice Reversal is just a shortcut to automate the whole reversal process. The same steps can be performed manually as well.

Reversing Invoice Partially Only

In case only a part of the invoice needs to be reversed, the user must do the following:

- Create one or more Income accounts on the shipment with negative values matching the amounts to be refunded.

- Create a new Credit Note under the Invoices tab and add these accounts to the Credit Note.

- Once satisfied with the Credit Note preview and amount, the Credit Note can be approved and finalized.

For any questions or clarification, please contact TrakIT Support.